Top 10 Best Virtual Dollar Card Providers in Nigeria (2026)

In Nigeria, the demand for virtual dollar cards has been on the rise due to the increasing need for online transactions. These cards offer a convenient and secure way to make payments in dollars without the need for a physical card or bank account in the United States. Virtual dollar cards are prepaid cards that can be used for online payments, subscriptions, and other transactions that require payments in dollars.

Virtual dollar cards have become increasingly popular in Nigeria due to their convenience and flexibility for online transactions. Whether you need to make purchases on international websites, pay for subscriptions, or transfer funds globally, getting virtual dollar cards offer a reliable solution. In this article, we will explore the top 10 virtual dollar card providers in Nigeria in 2026, highlighting their features, benefits, and factors to consider when choosing the right provider.

There are numerous virtual dollar card providers in Nigeria, making it challenging to choose the best one. The top ten best virtual dollar card providers in Nigeria (2026) offer various benefits, including low transaction fees, easy account setup, and instant funding. These providers include Chipper Cash, Bitsika Virtual Visa Dollar Card, Kuda Bank Virtual Dollar Card, Fundall Virtual Dollar Card, Payday Virtual Dollar Card, Mintyn Virtual Dollar Card, CashBuddy Virtual Dollar Card, Barter By Flutterwave, Neteller, and Virtual Payment Cards from PST.NET. Each of these providers has unique features that make them stand out in the market.

WHAT IS A VIRTUAL DOLLAR CARD?

A virtual dollar card is a prepaid card that allows users to make transactions in US dollars or other foreign currencies. Unlike traditional credit or debit cards, virtual dollar cards are not physically issued. Instead, they are generated electronically and provided to users digitally. They can be used for online purchases, subscriptions, or any other transactions that require foreign currency payments.

BENEFITS OF VIRTUAL DOLLAR CARDS

Virtual dollar cards offer several advantages over traditional payment methods. Here are some key benefits:

- Convenience: Virtual dollar cards can be created and managed online, eliminating the need for physical card delivery or visits to a bank.

- Global Acceptance: These cards are widely accepted by online merchants and platforms that support foreign currency transactions.

- Enhanced Security: Since virtual dollar cards are not linked to personal bank accounts, they provide an additional layer of security, reducing the risk of fraud and unauthorized transactions.

- Budget Control: Users can load a specific amount onto the virtual card, helping them stay within their budget and avoid overspending.

- No Credit Checks: Unlike traditional credit cards, virtual dollar cards don’t require credit checks or extensive documentation, making them accessible to a wider audience.

TOP 10 BEST VIRTUAL DOLLAR CARD PROVIDERS IN NIGERIA

Nigeria is a country with a growing fintech industry, and virtual dollar cards have become increasingly popular among Nigerians who want to make online transactions in dollars. These prepaid debit cards offer a convenient and secure way to shop online, pay for subscriptions, and make other online payments without the need for a bank account or credit card.

Now let’s dive into the top 10 virtual dollar card providers in Nigeria in 2026. These providers have been selected based on their reputation, user reviews, features, and overall customer satisfaction.

Here are Nigeria’s top rated virtual dollar card providers this 2026:

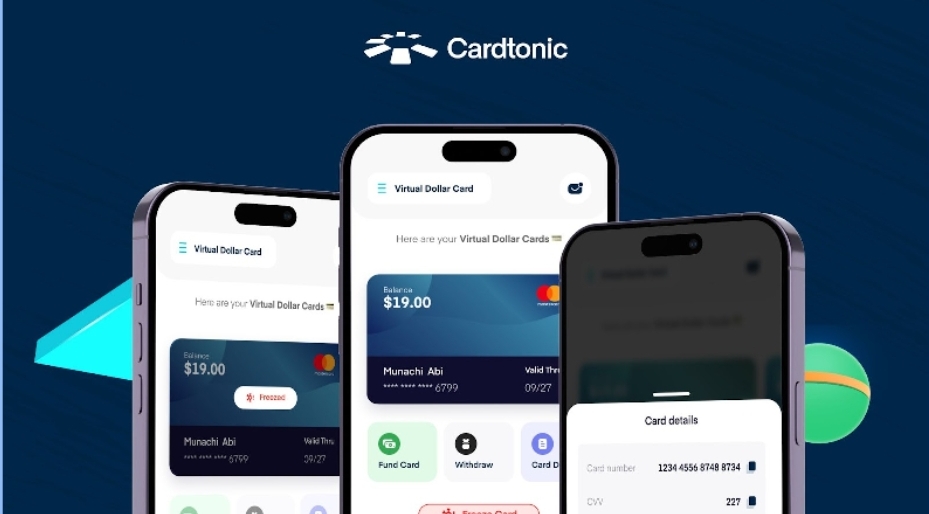

CARDTONIC VIRTUAL DOLLAR CARD

When it comes to seamless international payments, the Cardtonic virtual dollar card is in a league of its own. Whether you need to pay for subscriptions, shop on international websites, or run digital ads, this card ensures smooth, unrestricted transactions—making it the best virtual dollar card in Nigeria.

Unlike other providers that charge hidden fees or impose strict funding limits, Cardtonic keeps it simple and transparent. Creating a virtual dollar card costs just $1.50, and there are no monthly maintenance fees or surprise deductions.

Setting up your Cardtonic virtual dollar card takes just minutes. Simply log into the Cardtonic app, create your card, fund it instantly, and start making payments anywhere.

With strong security measures, instant funding, and top-tier customer support, Cardtonic offers Nigerians a reliable, secure, and stress-free way to handle online transactions. If you’re looking for the best virtual dollar card in Nigeria, Cardtonic is your go-to choice.

BARTER BY FLUTTERWAVE

Barter by Flutterwave is a popular virtual dollar card provider in Nigeria that offers a prepaid Visa card for online purchases and subscriptions. The card can be funded with Naira, Bitcoin, or other cryptocurrencies, and it can be used to make online purchases on Amazon and other international e-commerce websites.

Flutterwave, a Nigerian payment company, introduced the Barter app in 2019 with the aim of facilitating swift money transfers. Their expertise lies in mobile money and digital wallets, allowing them to seamlessly convert your physical cash into a digital wallet and vice versa.

The Barter app offers multiple funding options, including bank accounts, credit cards, and mobile payment accounts. With these options, you can engage in various transactions such as purchasing cryptocurrencies, engaging in online trading, using betting websites, or availing money transfer services.

Once you have funds in your Barter account, you can create a virtual dollar card. This virtual card can be used for convenient online payments on a majority of websites. It’s important to note that a minimum balance of $5 is required in your account to create a virtual card. Additionally, each virtual card incurs a cost of $2, along with a monthly fee of $1.

To acquire the Barter app, simply visit the Google PlayStore, install the application, create an account, request a card, and fund your newly created account.

ALAT VIRTUAL DOLLAR CARD BY WEMA

Alat is a fully digital bank in Nigeria that offers a virtual dollar card for online shopping and transactions. The card can be created and used securely on users’ phones, and it can be funded with Naira or other currencies.

Operated and owned by Wema Bank, the ALAT Virtual Dollar Card offers a comprehensive range of banking services, including a bank account, an actual debit card, savings, loans, and one of Nigeria’s leading virtual dollar cards.

Once you have successfully created and funded your account, you have the convenience of loading up to $20,000 onto your card directly from your Naira balance. Additionally, if needed, you can convert the dollars back into Naira. However, it is important to note that this card is not compatible with 3D Secure and cannot be used on websites that facilitate money transfers.

The ALAT virtual dollar card is highly recommended for individuals seeking to establish and finalize business transactions with vendors from various countries.

BITSIKA VIRTUAL VISA DOLLAR CARD

Bitsika is a fintech startup in Nigeria that offers a virtual Visa dollar card for online transactions. The card can be funded with Naira or other cryptocurrencies, and it can be used to make online purchases on Amazon and other international e-commerce websites.

Nigeria, along with numerous other African countries, has the opportunity to access the FinTech application called Bitsika. This innovative software enables individuals to conduct financial transactions seamlessly over the internet, eliminating the need to visit a physical bank and endure lengthy queues for hours on end.

By utilizing the Bitsika wallet, users gain the ability to engage in the buying and selling of various digital currencies, such as Bitcoin, ABCD stablecoin, and BUSD (Dollar stablecoin). Additionally, there is a nominal fee of $8 associated with obtaining the virtual dollar card. Nevertheless, the advantages of this card are evident as it grants users an exceptional online shopping experience, characterized by convenience and efficiency.

FUNDALL VIRTUAL DOLLAR CARD

Fundall is a Nigerian fintech company that offers a virtual dollar card for online transactions. Fundall provides a range of financial services that cater to diverse needs. Their offerings include loan facilities, digital wallets for secure money transfers, buyer protection for transactions conducted via the Fundall app, a reliable payment gateway for websites and applications, access to digital banking services that encourage savings, and comprehensive monthly statements.

KUDA BANK VIRTUAL DOLLAR CARD

Kuda Bank is a Nigerian digital bank that offers a virtual dollar card for online shopping and transactions. Nigerians have shown a great affinity for Kuda bank due to its status as a leading mobile banking platform in the country.

Apart from its remarkable provision of free physical debit cards and accessible low-interest loans to eligible and eager customers, Kuda goes beyond the ordinary realm of virtual card services.

WALLET AFRICA VIRTUAL DOLLAR CARD

Wallets Africa is a Nigerian startup that provides a digital wallet with virtual and physical naira and dollar Visa cards. These are issued by UBA, which means you are not limited to online transactions in dollars, making it ideal for traveling!

Wallet Africa is a Nigerian fintech platform that operates throughout various African countries, such as Ghana and Kenya. It remains relatively unfamiliar to numerous smartphone users within Nigeria.

The inception of Wallet Africa can be traced back to 2018, initiated by John Oke. Alongside providing tangible cards and immediate account statements, Wallet Africa also offers valuable assistance in generating virtual dollar cards specifically designed for online transactions.

These credit cards possess genuine attributes, making them ideal for travel, a challenge that countless Nigerians face due to the escalating incidents of theft.

MINTYN VIRTUAL DOLLAR CARD

Mintyn is a Nigerian fintech company that offers a virtual dollar card for online shopping and transactions.

This Nigerian digital banking institution also offers a wide array of financial solutions, encompassing corporate and individual banking accounts, savings options, and a host of additional services like instant loans and mutual funds.

As an added benefit, level 3 account holders are granted a complimentary virtual dollar card, which can be conveniently activated at any given moment.

CASHBUDDY VIRTUAL DOLLAR CARD

CashBuddy is a Nigerian virtual dollar service provider that empowers you to conduct seamless financial transactions on the web. This exceptional card allows you to conveniently pay for various online services acquired from any African nation, as well as receive secure payments for your own products and services.

To set up an account for the CaahBuddy dollar card, it is mandatory to have a minimum balance of $3 in your account. Once you meet this requirement, you can begin utilizing your card without incurring any overt or covert fees. Additionally, you have the flexibility to load up to $10,000 per month into your account, ensuring you have ample funds to cater to your financial needs.

GREY VIRTUAL CARD

Grey is another trusted Nigerian fintech startup that offers you an easy to use virtual dollar card for online trading, betting websites, and money transfer services. The card can be funded with Nigerian Naira or other currencies, and it can be used to make online transactions securely.

CHIPPER CASH VISA VIRTUAL CARD

Chipper Cash is a Nigerian fintech company that offers a virtual Visa dollar card for online transactions and mobile money transfers. The card can be funded with Naira or other currencies, and it can be used to make online purchases and subscriptions.

Chipper also introduced a remarkable virtual card that empowers you to initiate and conclude both domestic and global online transactions swiftly. Within a matter of minutes, you can seamlessly fund your card using your chipper wallet, without incurring any additional charges.

It is important to note that this convenient solution does come with certain limitations regarding funding and withdrawal capabilities. Daily withdrawals are restricted to a maximum of $1,000, and deposits into the card are also capped at $1,000 per day. Additionally, your daily spending on the card is limited to $1,000 as well.

FACTORS TO CONSIDER WHEN CHOOSING A VIRTUAL DOLLAR CARD PROVIDER

When selecting a virtual dollar card provider, it’s important to consider the following factors:

- Fees and Charges: Compare the fees associated with card issuance, transactions, currency conversion, and any other relevant charges.

- Card Limits: Check the limits imposed on card usage, such as transaction limits, load limits, and withdrawal limits.

- Ease of Use: Evaluate the provider’s user interface, mobile app functionality, and ease of card management.

- Customer Support: Look for providers that offer responsive customer support to address any issues or concerns promptly.

CONCLUSION

The use of virtual dollar cards are an excellent option for Nigerians who want to make online transactions in dollars without the need for a bank account or credit card. The above-listed virtual dollar card providers offer secure and convenient ways to make online purchases, subscriptions, and other online payments. Virtual dollar cards have revolutionized online transactions in Nigeria, providing a convenient and secure way to make payments in foreign currencies. When choosing a provider, consider factors such as fees, card limits, ease of use, and customer support.